Beware! Potential Indicators of Credit Card Fraud

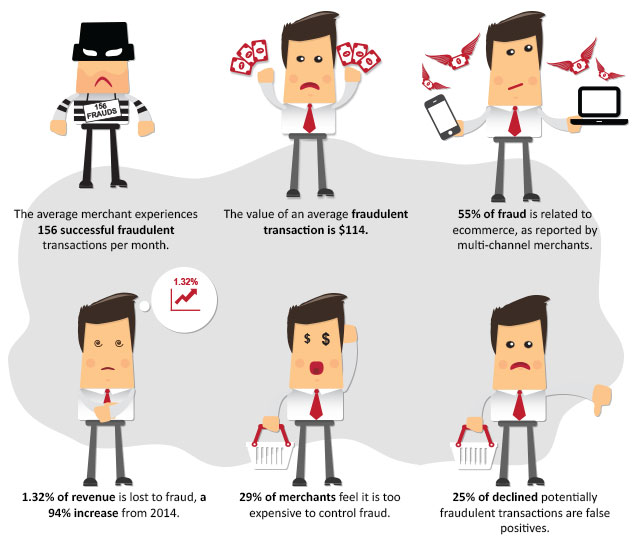

Card-not-present merchants face special challenges in the fight against fraud. Recent statistics paint an alarming picture.

By the Numbers

As more consumers turn to ecommerce for convenience, more criminals are drawn to ecommerce for their own gain.

How can the merchant fight fraudulent activity and reduce chargebacks? Is there a process that can help reduce or eliminate credit card fraud?

Red Flags: Indicators of Potential Credit Card Fraud

To identify potential credit card fraud, experts have identified red flags that may be indicators of fraud. Merchants need to be on the lookout for these things, as they are often associated with fraudulent transactions.

| Orders |

| New customers who are actually criminals looking for a new mark |

| Larger-than-normal orders |

| Ordering an abundance of the same item in different colors or sizes |

| Big-ticket items |

| Large orders with multiple payment cards |

| Multiple Purchases |

| Multiple orders shipping to the same address, but placed on different cards |

| Multiple orders shipping to different addresses, but placed on one card |

| Multiple orders coming from the same IP address with different cards |

| Multiple orders with similar card numbers |

| Transaction Issues |

| Declined purchases that are followed by smaller transactions on the same card |

| Incorrect expiration date |

| Difficulty providing personal information during telephone orders |

| Spelling errors or using all capital letters |

| Shipping |

| Rush shipping on large orders |

| Repeated inquiries about shipping and delivery dates |

| International shipping |

| Special Circumstances |

| Disinterest with price or specifics of items being ordered |

| Disinterest with company policies such as shipping, returns, warranties, etc. |

| Using deaf relay system to place orders |

Detecting Fraud: Art or Science?

These red flags may indicate potential fraud, but merchants shouldn’t assume every similar situation is a threat. Validation of questionable transactions can set the merchant’s mind at ease.

Many merchants hesitate to question a customer, fearing the loss of the sale or upsetting the customer. To the contrary, most legitimate customers will appreciate the extra measures to ensure the validity of the sale. Once a red flag is dismissed as a false positive, the merchant can process the transaction with confidence.

Evaluation of red flags can seem more art than science; there are no absolutes that indicate fraud to the average merchant. Carefully analyzing the indicators of fraud can help identify potential risks; however, this attention to detail won’t stop them all.

What About Fraud Filters?

Individually reviewing each transaction, looking for indicators of fraud, is a tedious task. Merchants will lose a lot of time and money engaging in such a labor-intensive process.

Not only are manual reviews time-consuming, their effectiveness is minimal. Despite their best efforts, merchants are unable to stay current on criminals’ latest tactics for engaging in credit card fraud. Particularly difficult for merchants who deal with card-not-present transactions, the technologically advanced criminals are adept at disguising fraud.

That’s why many merchants rely on fraud filters to identify potential credit card fraud. This automated tool streamlines the process, minimizing the merchant’s involvement.

Merchants can first automate the fraud detection and then manually review only those transactions labeled potential fraud.

When it comes time to review those transactions determined to be a high risk of fraud, merchants have two options.

Option #1: The DIY Review

Merchants use an automated system to detect potential fraud. Merchants may opt to decline all transactions that are labeled as questionable, resulting in a potential loss of revenue due to false positives.

Or, merchants will elect to manually review high risk transactions themselves, either allowing or denying the transaction based on the fraud red flags found.

One of the perks of a DIY strategy is in-house management allows the merchant total control of the fraud detection and prevention process. However, that pro is fairly insignificant compared to the primary con.

Merchants generally have minimal knowledge of the intricacies of fighting fraud. They are unable to distinguish fraud from false positives; this ultimately lowers revenue and escalates costs.

While the combination of manual and automatic reviews may reduce the number of chargebacks, it increases the cost of fighting fraud. Merchants allocate up to 20% of their fraud-detection budget to manual reviews, reinforcing the overall merchant attitude that controlling fraud is cost-prohibitive.

Option #2: The Outsourced Review

Merchants have the option to fully outsource the task of fraud detection to a risk mitigation specialist.

Fraud detection experts identify and analyze potential fraud, reducing the merchant’s involvement. The merchant is able to reallocate resources (like time and money) to growing the business, rather than completing tasks outside the merchant’s skillset.

With professional involvement, more fraud is successfully identified while the effects of false positives are minimized.

Identifying Fraud is a Complicated Task

Identifying fraud is a difficult task; however, it is one merchants must address. The cost of fraud is increasing; if left unchecked, fraud will threaten the business’s longevity.

Identifying fraud red flags and taking the necessary action to block criminal activity is the first step towards preventing chargebacks and retaining more revenue. It is one small piece of the bigger chargeback management puzzle.