Anticipating Fraud During the EMV Card Transition

What Merchants and Consumers Need to Know about EMV Fraud Trends

In 2014, US retailers lost $32 billion to payment card fraud, a 38% increase from the $23 billion lost in 2013. LexisNexis went on to report this fraud loss is equivalent to 0.68% of revenue.

Payment industry members are in the process of implementing a major technology shift in an attempt to stem the tide of fraud, but will it help?

What are EMV Cards?

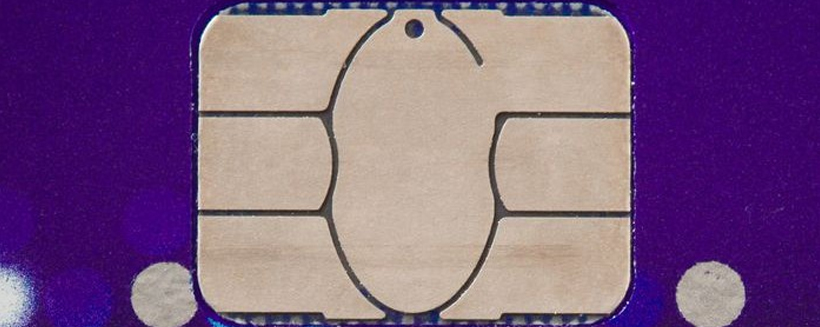

EMV, or Europay MasterCard Visa, is an anti-fraud technology. New payment cards and point-of-sale terminals are designed to help keep account information safe and secure.

Rather than store sensitive cardholder data in the magnetic stripe, EMV cards use a micro-chip. While traditional payment cards are swiped through a point-of-sale terminal, EMV cards are dipped into the card reader. Cardholders will validate the charge with either a 4-digit PIN number or a signature.

EMV cards have been widely accepted throughout Europe since their 2005 unveil. These chip cards have also been introduced in other parts of the world with the U.S. being the last developed country to make the transition.

U.S. issuing banks are currently in the process of distributing new EMV cards to consumers. The payment industry hopes to have the majority of cardholders and merchants transitioned to the new technology by October 1, 2015.

A Reduction in Counterfeit Cards

EMV cards were invented as a solution to card-present fraud that happens with counterfeit cards.

Criminals who gain access to stolen credit card information can easily create new magnetic stripe cards. These fake cards can then be used at any brick-and-mortar location.

Counterfeiting has become a major fraud concern, accounting for 37% of all credit card fraud in the U.S.

EMV technology will help reduce the risk of counterfeiting because EMV chips are nearly impossible to duplicate. Moreover, the mode of transmitting information with a magnetic card is vastly different from an EMV card.

With a magnetic stripe card, the same sensitive information is used over and over again. Merchants process and store this information with each transaction. With EMV cards, a unique one-time code is created for each individual transaction. If a hacker accessed this one-time code and tried to use it again, the transaction would be denied.

Statistics show EMV cards are helping reduce fraud. The U.S., the last country to adopt EMV, is responsible for half the word’s fraudulent payment card transactions. However, only 25% of the world’s transactions happen in the U.S.

An Increase in Card-Not-Present Fraud

While EMV cards are expected to reduce card-present fraud, experts anticipate card-not-present fraud will increase.

Why will fraud simply shift from one channel to another?

Brian Krebs, online fraud expert, stated, “Fraud doesn’t go away, it just goes somewhere else.” Credit card fraud is too big of a money-maker; criminals aren’t simply going to give up. They’ll merely move to the path of least resistance.

If criminals can’t generate counterfeit cards and make unauthorized transactions in the brick-and-mortar world, they’ll simply look for other, easier opportunities in the card-not-present environment.

Based on global stats, U.S. merchants can expect to suffer major losses in the coming years. In the three years after the U.K.’s EMV adoption, card-not-present fraud rose 79%. Australia and Canada, countries that also use chip cards, have each seen a 50% rise.

Dealing with EMV Fraud: Tips for Both Merchants and Consumers

Fraud turns both consumers and merchants into victims. Each party needs to take the necessary precautions to protect their assets as the upcoming EMV transition looms near.

Tips for Merchants

Fraud increases the risk of chargebacks, and chargebacks are a dangerous situation for merchants. Merchants need to increase their fraud protection mechanisms before EMV cards become mainstream.

- Use traditional fraud detection tools like 3D Secure (MasterCard SecureCode and Verified by Visa), card security codes, and Address Verification Service.

- Use Visa Account Updater to gain access to new EMV card account numbers for recurring transactions.

- Be on the lookout for common indicators of fraud. There are various red flags merchants should be watching for. Validate any transaction that seems suspicious.

- Use fraud filters.

- Receive chargeback alerts. Alerts allow merchants to refund customers for unauthorized transactions before a chargeback can be processed.

Merchants who aren’t aware of the EMV fraud trends will be easy targets. It is important to stay vigilant about fraud detection and prevention.

Tips for Cardholders

EMV technology protects cardholders from criminals who perpetrate card-present fraud. However, consumers will need to be prepared for an onslaught of unauthorized transactions on card-not-present channels (mail order, telephone order, and the internet).

- Carefully monitor accounts; watch for suspicious activity. This is especially true for debit card users. There is a much higher cardholder liability for debit cards. Fraud will need to be reported immediate, or the cardholder may not be protected.

- Sign up for 3D Secure with the respective card network, Verified by Visa or MasterCard SecureCode.

- Regularly check credit reports. Because criminals can’t manufacture fake cards, they’ll be tempted to apply for legitimate ones in your name. Application fraud and identity theft is poised to increase with the EMV adoption.

Criminals thrive on confusion. Be prepared for the new EMV card transition. Don’t let yourself, whether you are a merchant or consumer, be an easy target.