What is Friendly Fraud and How Does It Affect Merchants?

Friendly fraud is a relatively new threat to ecommerce merchants. It steals revenue and, if not managed properly, can threaten the longevity of a business.

Friendly Fraud Defined

Friendly fraud is not actually friendly; the action derived its name from the type of person committing the fraud. Friendly fraud is committed by seemingly satisfied customers, not gangs of criminals.

A more accurate description is chargeback fraud. Consumers use the chargeback system to gain an illegitimate refund.

Rather than contact the merchant for a traditional refund, friendly fraudsters will bypass the merchant and file a transaction dispute with the bank instead. Consumers will use any excuse necessary to get their money back.

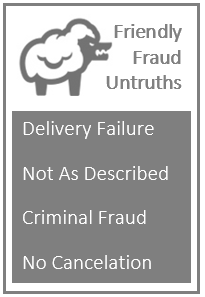

Common examples of friendly fraud include:

- Claiming a product or service wasn’t delivered (when it actually was)

- Claiming merchandise or services are inadequate for their intended purpose, damaged, or not as described (when they are actually just fine)

- Claiming a transaction wasn’t authorized (when it actually was)

- Claiming a recurring transaction wasn’t canceled as requested (when the cardholder never actually requested termination)

Why Friendly Fraud Happens

Friendly fraud is a crime of convenience. In fact, more than 80% of chargebacks are filed out of convenience; the cardholder simply doesn’t have time to deal with the merchant.

In other situations, the cardholders are ignorant of their actions. They don’t understand the difference between a refund and a chargeback, nor the implications of a chargeback.

In general, cardholders have learned to exploit loopholes in the chargeback process and engage in cyber shoplifting.

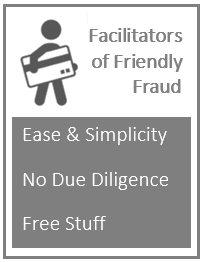

More specifically, savvy customers have learned three things:

- It’s easier to file a chargeback than request a refund. Banks make the process simple by displaying a “dispute” button on the customer’s online statement. Rather than jump through the hoops of the merchant’s return policy, consumers can dispute a transaction in just a couple of minutes.

- Banks are reluctant to tarnish the relationships they’ve established with their customers. Financial institutions are quick to fulfil chargeback requests because they think this is the key to providing high-quality customer service. Banks don’t adequately research a cardholder’s claim or validate the argument. After all, “the customer is always right.”

- Friendly fraud is essentially cyber shoplifting. Customers can easily get something for free. Whether they set out with the intention of robbing the merchant or not, these consumers—who would never consider themselves thieves—are stealing from innocent businesses.

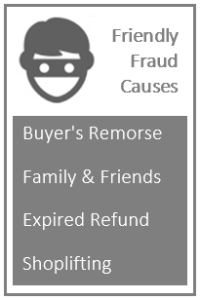

Friendly fraud usually results from one of the following situations:

- The cardholder suffers from buyer’s remorse and regrets making the purchase.

- An authorized card user (family member, friend, etc.) makes a purchase but the primary cardholder doesn’t want to honor the transaction.

- The cardholder fails to secure a refund before the return time limit expires.

- The cardholder sets out with the intention to get something for free.

The Cost of Friendly Fraud

Most industry members point to the broad-spectrum friendly fraud statistics that involve everyone. For example, friendly fraud contributes to nearly $16 billion in losses annually (compared to just $3 billion caused by credit card fraud).

However, it is important to analyze the impact of friendly fraud on an individual level.

The Impact of Friendly Fraud on Merchants

There are several obvious ramifications of this type of theft, but there are also less obvious side-effects of friendly fraud.

- Each incident of friendly fraud means the merchant loses the revenue associated with the purchase and all future potential for profitability.

- The merchant also forfeits the cost of the sale, including transaction processing fees, advertising fees, and more.

- Chargeback fees, which range from $20 to $100 each, are assessed for each transaction dispute.

- If chargeback rates become excessive, a ratio of more than 1-2% of chargebacks to monthly transactions, the acquiring bank will terminate the merchant’s processing account.

- Merchants who lose the ability to process credit card payments with a traditional bank must look for a high-risk payment processor. High-risk accounts have additional fees and penalties.

- Because of the extra costs associated with high-risk accounts, most merchants must simply close the business if excessive chargeback rates lose them their credit card processing account.

Unfortunately, many of these consequences are unknown to consumers when they engage in friendly fraud. And merchants are unaware of how serious the threat of friendly fraud is. Friendly fraud might seem like an annoying nuisance or simply a cost of doing business; but without proper management, friendly fraud can easily cause a business’ demise.

The Impact of Friendly Fraud on Consumers

Implying that consumers are negatively affected by friendly fraud might seem absurd. After all, they are the ones getting something for free. While it’s true the merchant is the primary victim of friendly fraud, consumers can suffer too.

- If a merchant successfully disputes an illegitimate chargeback, the consumer may have to pay the applicable chargeback fee.

- If a bank suspects the consumer is filing fraudulent chargebacks, the bank may close the cardholder’s account. A closed account could negatively affect the consumer’s credit score.

- To compensate for profit losses caused by friendly fraud chargebacks, merchants are raising their prices. Innocent consumers pay more for products and services because of fellow consumers’ attempts to get something for free.

Taking the Next Step

Friendly fraud will continue to ravish the payment industry until consumers curb their harmful behavior and merchants take a stand against the injustice.

Education is the first step. Merchants and consumers need to understand what’s really involved in friendly fraud chargebacks. Next, merchants need to fight back.

Disputing illegitimate chargebacks sends a powerful message to payment industry members. It reminds everyone involved that loopholes in the chargeback process need to be closed and financial institutions need to perform the necessary due diligence.

There are prevention and dispute tactics available to those merchants who chose to fight against the injustice of friendly fraud. Take the necessary action to recoup revenue that never should have been sacrificed and help turn the tables against friendly fraudsters.