Making the Most of the Business Model Embraced by Millennials

Consumers and businesses constantly experiment with new ways to trade and share ideas. One of the best examples is in the rapid growth of the “subscription economy”—a reference to the rise in long-term business models based on recurring billing.

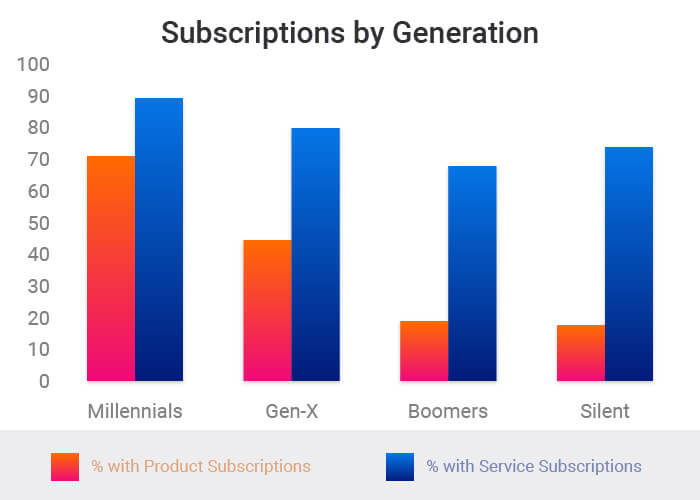

However, consumers are embracing the subscription economy at very different rates across product categories and age groups.

Millennials Love Recurring Billing

Research from Vantiv suggests: Millennial consumers are more open to recurring billing schemes than their older counterparts. This is especially true regarding product subscriptions, as opposed to recurring services.

Roughly 7 out of 10 Millennial consumers report having at least one product subscription—more than four times higher than the portion of seniors with such services.

The authors of the study suggest that this is not motivation to try and capitalize on older shoppers and convert them to recurring buying models. Rather, this is a sign to “double-down” on younger-Millennial and post-Millennial buyers, whose combined purchasing power will surpass USD $1.5 trillion annually by 2020.

Subscription Models Benefit Merchants & Consumers

Those born after 1980 are expected to further embrace this business model as they come to dominate a greater share of consumer spending. That’s reason enough for merchants to invest in new and broader recurring billing strategies as the subscription economy offers enormous potential benefits for merchants and consumers alike.

Consumers

Recurring billing can break down expensive purchases into smaller, more-affordable payment installments.

[Picture of money being divided? A big pile vs a small one?]

Take Adobe, for example—the company originally operated by commanding a large up-front cost for unlimited use of their products. However, the company’s new Creative Cloud model allows users to pay a small monthly fee in exchange for ongoing access to programs as they’re needed. The former model put these products outside the range of many consumers, but breaking the cost into small monthly installments democratizes access and broadens the pool of consumers.

Recurring billing is essentially a turnkey solution for many products. The customer receives the goods and services they want, delivered to their door (or screen), without the need to think about them until they decide to terminate the service.

Merchants

Recurring billing schemes tend to substantially increase the lifetime value of individual customers.

With individual transactions, the customer must act to complete the sale. With recurring billing, though, the sale will occur regularly until the customer acts to stop it. Payments are automatically charged to the account regularly, and the customer receives their good or service without the need to think about it any further. The cost of retaining a customer is very low, and there is little risk of the buyer switching brands.

The Potential Downside of Recurring Billing

Recurring billing can be a high-value revenue strategy, but it can also lead to additional complications for merchants. For example, card expiration dates could result in declined transactions, and customer changes of address can lead to lost merchandise. This is especially true of Millennial-consumers who came of age in an always-connected environment and are more accustomed to “set it and forget it” solutions.

To make matters worse, improperly-administered recurring transactions can easily turn into chargebacks, resulting in further losses and potentially jeopardizing the entire business. The consequences of chargebacks include:

- Lost sales profits

- Unrecoverable merchandise

- Chargeback fees imposed by banks

- Potential termination of acquiring account

- Loss of card processing rights

Best Practices for a Subscription Model

The risks associated with a recurring billing model may be higher, but so are the potential rewards. Given Millennials’ preference for this business model and their dominance of the consumer market, more and more merchants will feel the pressure to offer subscription and recurring schemes.

Fortunately, it is possible to enjoy the benefits of subscription billing while minimizing the risk.

Recurring billing can be very lucrative if merchants make use of tools to facilitate and secure the process, such as Visa Account Updater. This program automatically updates cardholder information in real time, ensuring that recurring transactions go ahead as normal even when cardholder information changes.

Other simple practices to loss-proof merchants’ strategies include:

Use Easy-to-Understand Billing Descriptors

The threat of customers failing to recognize a charge is doubled if the merchant does not use a simple and straightforward billing descriptor. While these labels often feature an address, this may be detrimental and confusing in an eCommerce setting, leading customers to suspect fraud.

Online sellers should always list their website name and a phone number in the billing descriptor.

Remind Customers before Billing

It’s easy for people to forget about passive processes like recurring billing. It’s best to remind customers shortly before the billing date that funds are about to be withdrawn from their account so they do not see the charge and automatically assume it is fraudulent.

Adhere to Customer Service Best Practices

Customers may decide to alter or end their service at any time; however, if it is too difficult to achieve through the proper channels, a customer may simply request a chargeback. This can be avoided by providing excellent and attentive customer service:

- Make contact easy to find and accessible from any page on the website

- Have live customer service representatives available 24/7

- Answer phone calls within three rings

- Respond to email and social media inquiries within 60 minutes

Keep Detailed & Accurate Records

It’s essential to have the relevant information on standby, to protect retailers from chargeback claims. Storing this information under PCI-compliant conditions could mean the difference between successfully fighting a chargeback and losing out on revenue and sustainability.

Make it Easy to Terminate Service

Merchants don’t want to make it any more difficult than necessary for consumers to terminate their service. Otherwise, frustrated customers may opt to commit friendly fraud to avoid further payments.

Provide a straightforward channel, so subscribers can end their service quickly and without hassle.

Embrace Recurring Billing, but Do it Wisely

Recurring billing schemes aren’t going anywhere.

Younger consumers tend to opt for these simple subscription models whenever possible. In response, merchants upend the status quo in an increasing number of product and service categories by introducing recurring billing options. However, the desire to capitalize on the subscription model must go hand-in-hand with best practices.