Merchants are pretty well aware of friendly fraud by now, and for good reason. The problem has been getting consistently worse for over the last decade. It’s also a compounding problem.

Why is this the case? Well, there are many reasons, but chiefly, it’s because digital commerce has become increasingly popular in the last few years.

According to Forbes, eCommerce will account for 20.4% of global retail sales by the end of 2022, up from only 10% five years ago. With those figures comes an inevitable spike in card-not-present and first-party fraud (known as “friendly” fraud). It’s a predictable peril of a post-Covid digital payments landscape. After all, it’s easier to commit fraud online than it is in person, and even legitimate cardholders and merchants have been on the frontlines of this problem.

There are growing merchant concerns about friendly fraud and the need for improved dispute management systems. To answer this, Visa is taking steps to challenge friendly fraud directly from their merchant dispute portal.

Visa Compelling Evidence 3.0 will expand the list of compelling evidence merchants can provide to help invalidate certain customer disputes. In turn, this will improve merchants’ chances of winning those disputes.

What is CE 3.0? When Does it Drop?

Visa’s Compelling Evidence 3.0 ruleset governs disputes marked with a Visa reason code 10.4: Other Fraud–Card-Absent Environment.

This reason code is generally associated with friendly fraud. So much so, in fact, that you might even say it’s been repurposed to specifically target merchants and perpetrate fraud.

Visa CE 3.0 encourages merchants to supply historical purchase evidence to prove the cardholder was behind an order. If certain elements can be verified (device fingerprint, IP address, etc.) to have been used in two previously undisputed transactions, any current fraud claim will be denied.

Visa Compelling Evidence 3.0 is scheduled for launch on April 15, 2023. This could still change at Visa’s discretion, though, if they determine that more time is needed for compliance purposes.

How it Works

Visa Compelling Evidence 3.0 expands the definition of “compelling evidence” by allowing merchants to produce evidence of two previous transactions. These must be older than 120 days, not have been reported as fraud, and must be associated with the disputed transaction.

Also, only two of four points need to connect:

- IP address

- Device ID or fingerprint

- Shipping address

- Account login ID (mandatory match)

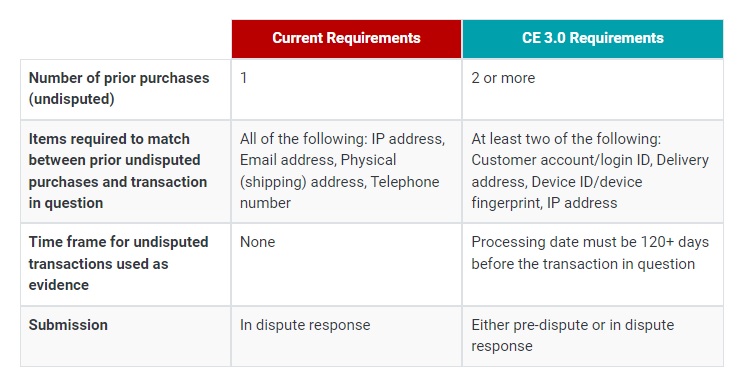

In addition to the account credentials, at least one of the submitted data points must be the IP address or device ID. This chart provides a side-by-side look at the old and new requirements:

Of course, these rules aren’t exactly clear-cut. There appears to be quite a lot of wiggle room between the old rules and the new ones, and the language is slightly confusing. I presume that Visa will iron out many of these kinks before the April 2023 launch date, or release the platform in beta to discover what works (and what does not).

Pros & Cons of Visa CE 3.0

The “pros” of Visa CE 3.0 aren’t exactly numerous, but they would be considerable.

If proven effective, CE 3.0 could lead to fewer chargebacks, lower chargeback rates, and more streamlined representments with the opportunity to supply more varied evidence. All of these things are sure to interest merchants, but are they idle boasts?

Well, one rather glaring “con” that I can see is that the rules will be stricter than Visa’s previous dispute management systems. They may also be more confusing.

Matching two factors from two previous orders with a current transaction seems to herald an unnecessarily nebulous process. This would add to merchant workloads without extending their time limits. The result could be a hassle with undefined (and unpromised) returns.

Besides this issue, there is no way to know which merchants will benefit most from the platform and which it could potentially stymie. CE 3.0 does appear to be tailored toward subscription and recurring payment-based business models. But that hardly means it will be a good fit for brick-and-mortar retailers and traditional eCommerce merchants.

Visa CE 3.0 won’t launch for several months yet. Thus, many details are still left to the imagination. With April 2023 still months away, any pros and cons the platform poses for merchants are yet to be determined.

What Merchants Should Do

Frankly, we really won’t know any more until Visa launches CE 3.0. In the meantime, I would strongly advise merchants to optimize their in-house practices sooner rather than later. If these platforms are to be of any use to merchants, their management and mitigation systems will likely need an upgrade.

Here are three key areas I recommend merchants shift focus for the short and long terms:

- Streamline Data Retrieval: Visa CE 3.0 will require ready access to historical transaction data. Merchants should ensure they have systems in place to retrieve and catalog data swiftly and accurately.

- Get on Board With Order Insight: Order Insight can drastically improve a merchant’s interaction and collaboration with Visa during a dispute. Merchants should seriously consider embracing this platform before utilizing Visa CE 3.0.

- Get Professional Help: Banks and third-party risk management service providers are uniquely placed to assist merchants during this transition. Each institution boasts a wealth of expertise that many merchants would find extremely helpful during this process.