Every year, our team at Chargebacks911 conducts an in-depth survey, soliciting responses from thousands of merchants in different verticals. The responses to these surveys are collected and used to create our annual Chargeback Field Report, offering retailers, financial institutions, and other stakeholders a cross-view of the current state of chargebacks.

While the official publication date is still a couple of weeks away, we do have the preliminary data from the report now available.

There are some really interesting findings throughout. Today, though, I wanted to highlight one point in particular: the rapid growth in acceptance of P2P (or “peer-to-peer”) payments among merchants.

Peer-to-Peer Payment Acceptance Exploding Among eCommerce Merchants

As part of the survey, we ask participants, “What payment methods do you accept other than credit cards?”

This question is meant to gauge the diversity of payment alternatives available to customers and to explore the associated opportunities and risks these methods might entail. We gathered information on several alternative payment methods, such as digital wallets, bank transfers (ACH), and cryptocurrency. In reviewing the new survey results against last year’s data, we noted that acceptance rates for most payment options remained relatively stable. P2P payments were a notable exception.

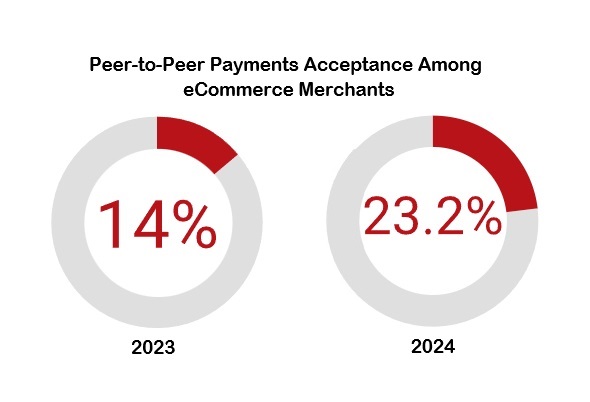

In 2023, around 14% of merchants indicated that they accepted peer-to-peer payments via platforms such as PayPal, Venmo, Cash App, and Zelle. However, when we posed the same question this year, the affirmative responses rose significantly to 23.2%.

That’s roughly a 66% increase in just one year. Remarkably, this also means that almost a quarter of all merchant respondents are now adopting these payment services.

Why P2P?

It’s evident that retailers are showing increased enthusiasm for incorporating peer-to-peer payment options at the checkout. But what makes this option so attractive for customers?

Using P2P payment applications comes with several notable benefits compared to traditional payment processing methods. For example, there’s familiarity. Consumers like options, but they tend to like familiar options. And, each of these apps already have their own dedicated user bases.

There’s also convenience to consider. In a lot of cases, using P2P apps at checkout can allow for faster and more seamless experiences. This is especially a bonus for sellers targeting Millennial and Gen-Z buyers, who are already frequent users of apps like Venmo and Cash App.

Finally, there are the costs to consider. P2P payment apps will often offer lower transaction fees when compared to conventional card-not-present payments.

Are There Risks Involved?

All that said, we also inquired among merchants regarding the potential risks linked to emerging payment methods. And, when we posed the question, “Do you believe that the introduction of alternative payment options raises the risk of fraud?” 60% of those surveyed said they felt alternative payments indeed heightened their risk.

It’s challenging to definitively say at this point that alternative payment methods inherently increase risk. But, the concerns surrounding fraud associated with peer-to-peer payments are certainly justified to an extent.

Fraudsters are known for their resourcefulness and continuously seek ways to exploit new technologies to their benefit. They employ advanced strategies to deceive merchants and can modify these tactics as situations evolve. The existence of various professional “fraud as a service” providers in the market highlights this ongoing challenge.

The Opportunity May Outweigh The Risk

Merchants must strive to establish effective fraud detection and prevention strategies, irrespective of the payment options they offer. This includes practices such as monitoring transactions, scrutinizing data for any unusual patterns, and employing robust authentication techniques, all of which are essential for managing risk.

Additionally, by diversifying payment methods, merchants may complicate the process for fraudsters attempting to exploit a single weakness within their system. Therefore, while acknowledging the potential risks, I believe that adopting P2P payment options not only allows merchants to cater to a broader range of customer preferences but also enhances customer satisfaction while aiding in risk management.

Though concerns regarding increased fraud risk with alternative payment options persist, the advantages are likely to outweigh the potential downsides. Ultimately, merchants should carefully evaluate the risks in light of the possible benefits when considering the adoption of any new technology.