What Every Merchant Needs to Know About Chargebacks

Sadly, there is a topic of discussion that is often omitted from conversations about business startups. Despite an ecommerce newbie’s best efforts to embark on a well-researched, carefully structured endeavor, there is one subject merchants know very little about.

And that lack of knowledge can easily lead to a business’s demise.

Chargebacks: The Unspoken Threat

Chargebacks steal revenue, increase costs, and threaten the longevity of a business. But what are chargebacks?

Chargebacks are a forced credit card refund. The cardholder’s financial institution removes funds from the merchant’s bank account and credits the cardholder. The chargeback process essentially voids a credit card transaction, removing any earning potential the merchant might have had.

There are several reason why chargeback education is usually omitted from startup discussions.

- Few startup mentors are able to definitively provide expert advice on the subject of chargebacks.

- Merchants assume chargebacks are just a cost of doing business, and there is nothing that can be done.

- Chargebacks make business owners feel like a failure, and no one wants to expose their deficiencies.

It’s time to remove the cloak of mystery and expose chargebacks for what they are: a biased form of consumer protection that jeopardizes a merchant’s success.

Legitimate vs. Illegitimate Use of Chargebacks

A chargeback definition that paints transaction disputes as a consumer protection mechanism hardly seems like a dangerous ecommerce liability.

After all, consumers should be protected in fraudulent situations. If criminals gain access to credit card information and make unauthorized transactions or a merchant intentionally cheats shoppers, the cardholder shouldn’t have to cover the cost of the fraud.

For example, a small sampling of chargeback reason codes shows how chargebacks protect consumers:

- The services were not provided or the merchandise was not received.

- The transaction was unauthorized, a fraudulent purchase made by a criminal.

- The purchased item or service was defective or not as described.

Unfortunately, the chargeback process isn’t always used for its intended purpose. Consumers have discovered how to exploit loopholes in the chargeback process and gain an illegitimate refund from the bank.

Consumers turn to the bank for a chargeback instead of securing a traditional refund from the merchant. Cardholders view a chargeback as a quick and easy way to get their money back. Called friendly fraud, this process is synonymous with cyber shoplifting.

Unless the merchant figures out how to stem the tide of friendly fraud, the business will get washed away.

Four Reasons Why Merchants Need to Manage Chargebacks

Those who are new to the subject of chargebacks need to understand the ramifications of each transaction dispute and the long-term effects to the business.

1. Chargebacks steal revenue.

Each chargeback filed forcibly removes funds from the merchant’s bank account. Unlike a traditional refund, this withdraw comes without any warning.

If merchants don’t dispute illegitimate chargebacks (friendly fraud), there is no way to recover the lost revenue.

Not only do merchants need to fight back against friendly fraud, they need an effective strategy. Otherwise, chargeback disputes could actually decrease profitability and increase risks.

2. Chargebacks increase costs.

Each chargeback is accompanied by a chargeback fee. This fee can range from $20-$100 each. Additional expenses include the cost of the goods sold, processing fees, and the labor it takes to respond to each transaction dispute.

3. Chargebacks jeopardize the business’s longevity.

Card networks (Visa, MasterCard) carefully monitor each merchant’s chargeback activity. If chargeback rates get too high, the card network could demand the bank terminate the merchant’s processing agreement.

Few merchants are given the chance to rectify excessive chargeback levels; punishments are meted out quickly and without warning to those merchants deemed “risky.”

If the merchant’s processing agreement is terminated, the business forfeits the right to accept credit card payments. To regain credit card processing abilities, the merchant will need to obtain a high risk payment processing account. These accounts come with unbearably high fees and revenue restrictions.

4. Chargebacks perpetuate the cycle of friendly fraud.

Friendly fraud flourishes because of a vicious cycle.

- Cardholders file chargebacks, ignorant of the ramifications to the merchant.

- Banks don’t want to risk the relationship they have with customers (cardholders), so they facilitate chargebacks without due diligence because the customer is always right.

- Merchants don’t fight friendly fraud because it is assumed to be a cost of doing business.

There is little incentive for consumers and banks to change their behavior because merchants don’t fight back.

Merchants who dispute chargebacks help effectuate industry-wide change. Fewer chargebacks would be filed if more merchants helped expose the fraudulent activity.

Taking the Next Step

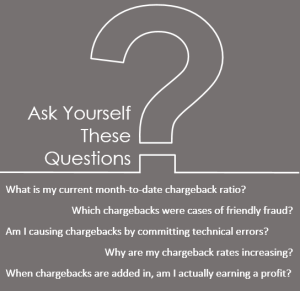

Understanding what chargebacks are is just the tip of the iceberg. Mastering the chargeback process, and all its regulations, is a vast undertaking.

While it is essential for businesses to carefully manage chargebacks, it isn’t an easy task to perform. Those who are just learning about chargebacks should consider taking the following steps:

- Learn all the intricate details of the chargeback process.

- Consult Visa and MasterCard’s extensive chargeback policies and regulations. These documents are regularly updated, so merchants need to routinely check for the most current editions.

- Implement a detailed chargeback prevention strategy. There are several small tweaks a merchant can make to the business’s policies and practices that will greatly improve profitably.

- Start disputing illegitimate chargebacks. Merchants won’t win back revenue if they don’t fight!

- Get professional help. Only a small percentage of chargebacks can be prevented and disputed with DIY strategies. Assistance from a professional chargeback analyst ensures profits will remain high and chargeback rates will remain low.

Chargebacks have remained a taboo topic for far too long. While merchants have failed to address the issue of chargebacks, consumers have gotten the upper hand and created a friendly fraud epidemic. It’s time to tip the scales back in the merchant’s favor and create a sustainable, profitable ecommerce environment.